Inheritance and the right to property are fundamental aspects of Indian society, often intertwined with family dynamics, cultural practices, and legal nuances. Navigating the maze of inheritance laws can be challenging, especially given the diversity of personal laws based on religion and community in India. This comprehensive guide aims to demystify property inheritance laws in India, explaining your rights and the processes involved in a clear and accessible manner.

Inheritance and the right to property are fundamental aspects of Indian society, often intertwined with family dynamics, cultural practices, and legal nuances. Navigating the maze of inheritance laws can be challenging, especially given the diversity of personal laws based on religion and community in India. This comprehensive guide aims to demystify property inheritance laws in India, explaining your rights and the processes involved in a clear and accessible manner.

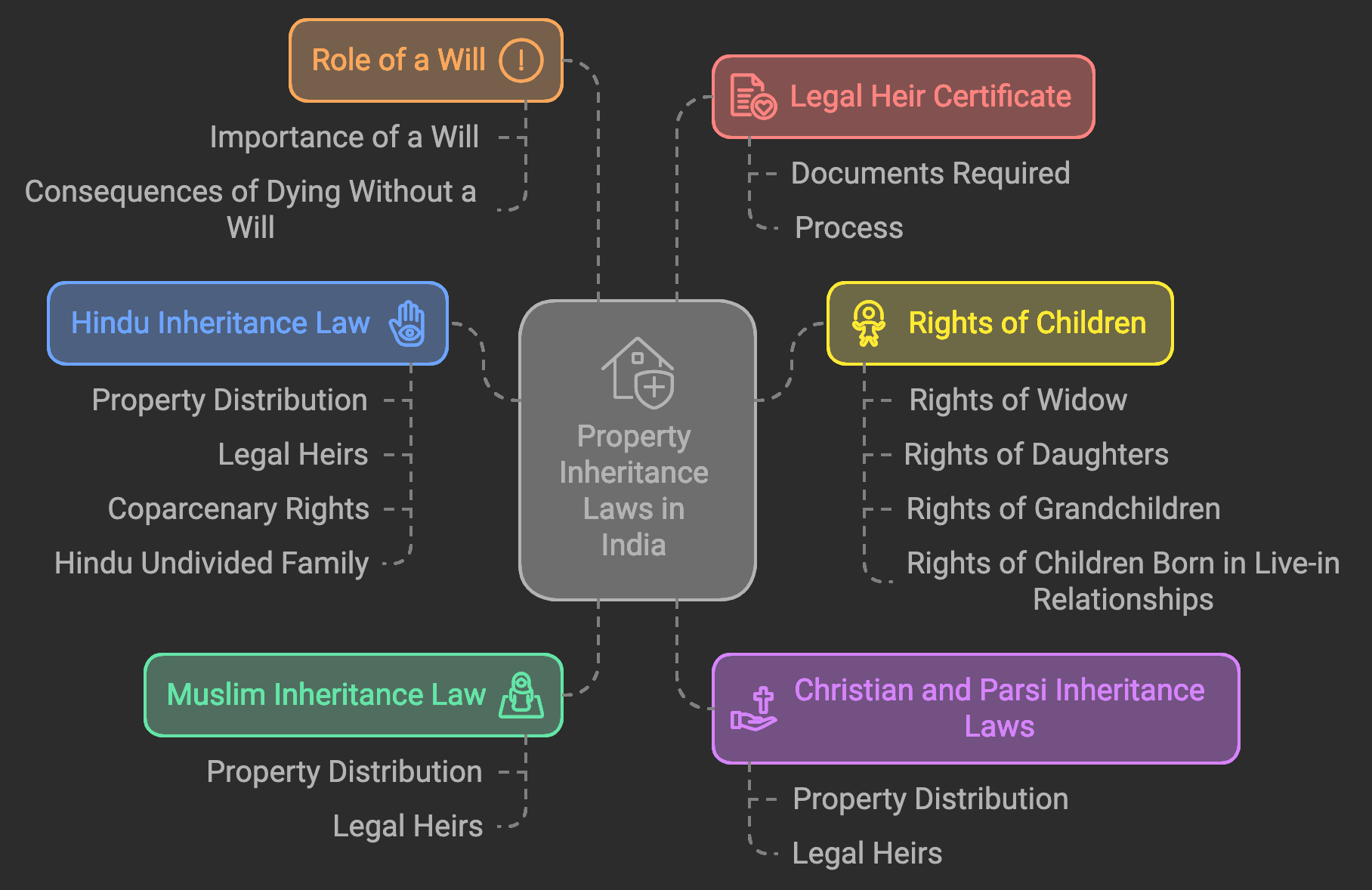

Table of Contents

- Introduction to Property Inheritance Law in India

- Types of Property That Are Inherited

- Understanding Hindu Inheritance Law in India

- Inheritance Laws for Muslim Community

- Inheritance Laws for Christians and Parsis

- Rights of Natural and Adopted Children

- Role of a Will in Succession Laws

- Documents Required for a Legal Heir Certificate

- What Happens Without a Will?

- Frequently Asked Questions

- About Sooper Kanoon

- Conclusion

What Is the Property Inheritance Law in India?

Property inheritance laws in India determine how the assets of a deceased person are distributed among their heirs. These laws are influenced by:

- Statutory Laws: Legislation enacted by the government.

- Personal Laws: Customs and religious laws applicable to different communities.

The primary legislations governing inheritance in India are:

- Hindu Succession Act, 1956 (amended in 2005)

- Muslim Personal Law (Shariat) Application Act, 1937

- Indian Succession Act, 1925

Inheritance can occur in two ways:

1. Laws of Intestate Succession

When a person dies without leaving a valid will, they are said to have died intestate. In such cases, their property is distributed according to the succession laws applicable to their religion.

2. Will or Testaments Under the Indian Succession Act of 1925

If a person dies leaving behind a valid will, their property is distributed according to the terms specified in the will. The Indian Succession Act, 1925, provides the legal framework for wills, except for Muslims, who have their own personal laws regarding wills.

What Are the Types of Property That Are Inherited?

Understanding the types of property is crucial in inheritance matters:

- Ancestral Property: Property inherited up to four generations of male lineage. It is shared equally among legal heirs.

- Self-Acquired Property: Property purchased or acquired by an individual through their own resources or received as a gift or inheritance.

Understanding Hindu Inheritance Law in India

The Hindu Succession Act, 1956, governs the inheritance laws for Hindus, Buddhists, Jains, and Sikhs. The Act was amended in 2005 to make inheritance rights more equitable.

Property Distribution Under Hindu Law

The legal heirs are classified into classes:

- Class I Heirs: Include immediate family members.

- Class II Heirs: Include more distant relatives.

Class I Heirs:

- Son

- Daughter

- Widow

- Mother

- Son of a pre-deceased son

- Daughter of a pre-deceased son

- Son of a pre-deceased daughter

- Daughter of a pre-deceased daughter

- Widow of a pre-deceased son

Distribution: If a Hindu male dies intestate, his property is divided equally among all Class I heirs.

Class II Heirs:

If there are no Class I heirs, the property passes to Class II heirs, which include:

- Father

- Brother

- Sister

- Other relatives specified in the Act

Who Are Classified as Legal Heirs Under Hindu Law?

Legal heirs under Hindu law include:

- Spouse: The widow is entitled to an equal share.

- Children: Sons and daughters (including adopted children) have equal rights.

- Mother: Has an equal share as a Class I heir.

- Heirs of pre-deceased children: Children of a deceased son or daughter inherit by representation.

Coparcenary Rights and Hindu Undivided Family

A coparcenary consists of members within a HUF who acquire a right in the ancestral property by birth. After the 2005 amendment:

- Daughters are recognized as coparceners, having the same rights as sons.

- They can demand partition and have equal liabilities.

What Happens When a Coparcener Dies?

- Their share in the ancestral property passes to their legal heirs.

- The property is divided among surviving coparceners and the deceased’s heirs.

Understanding Muslim Law of Inheritance

Muslim inheritance laws are governed by:

- Muslim Personal Law (Shariat) Application Act, 1937

- Sunni and Shia Schools of Law

Key Features:

- No distinction between ancestral and self-acquired property.

- Inheritance opens only after the death of the person.

- Fixed shares are allotted to specific heirs (Quranic heirs).

Distribution Principles:

- Widow:

- One-fourth share if there are no children.

- One-eighth share if there are children.

- Widower:

- Half share if there are no children.

- One-fourth share if there are children.

- Children:

- Sons receive twice the share of daughters.

Heirs:

- Sharers: Entitled to fixed shares.

- Residuaries: Receive the remainder after sharers’ claims.

- Distant Kindred: Inherit if no sharers or residuaries exist.

Understanding Christian Laws of Inheritance

Under the Indian Succession Act, 1925, Christian inheritance laws apply.

Key Provisions:

If a person dies intestate:

- Leaving a spouse and lineal descendants (children, grandchildren):

- Spouse receives one-third.

- Remaining two-thirds divided equally among lineal descendants.

- Leaving a spouse but no lineal descendants:

- Spouse receives half.

- Remaining half goes to kindred (relatives).

- No spouse or lineal descendants:

- Property distributed equally among kindred.

Parsi Inheritance Laws:

- Equal distribution among widow and children.

- Parents receive half the share of each child.

- If a child predeceases, their share goes to their heirs.

Rights of Natural and Adopted Children

Rights of Widow

- Recognized as a Class I heir under Hindu law.

- Entitled to an equal share of her husband’s property.

- Has rights over both self-acquired and ancestral property.

Rights of Daughters

- Post-2005 amendment, daughters have equal rights as sons.

- Can become a Karta (manager) of HUF.

- Have the right to demand partition.

Rights of Grandchildren

- Inherit only if their parent (the deceased’s son or daughter) predeceased the grandparent.

- They step into the shoes of their deceased parent.

Rights of Children Born in Live-in Relationships

- Considered legitimate.

- Have inheritance rights over the self-acquired property of parents.

- The Supreme Court has upheld these rights to prevent discrimination.

Role of a Will in Succession Laws

A will is a legal declaration of a person’s intention regarding the distribution of their property after death.

Importance of a Will:

- Allows for distribution according to personal wishes.

- Can be used to include or exclude certain heirs.

- Helps prevent disputes among heirs.

Key Points:

- Must be signed by the testator in the presence of at least two witnesses.

- Can be registered with the registrar or sub-registrar.

- Can be revoked or altered anytime during the testator’s lifetime.

What Are the Documents Required for a Legal Heir Certificate?

A Legal Heir Certificate is essential for transferring assets of the deceased to the heirs. Documents required include:

- Application form (signed by all legal heirs).

- Identity and address proof of the applicant.

- Death certificate of the deceased (original and copy).

- Proof of relationship with the deceased (birth certificates, marriage certificates).

- Affidavit or self-declaration.

- Address proof of the deceased.

Procedure:

- Submit the application to the Tehsildar/Taluk office or district civil court.

- Verification by local revenue officers and authorities.

- Issuance of the certificate after successful verification.

What Happens Without a Will?

Dying without a will (intestate) leads to:

- Property distribution according to personal laws, which may not reflect the deceased’s wishes.

- Potential disputes among heirs due to unclear entitlements.

- Delays in asset transfer due to legal formalities.

Consequences:

- Lack of control over who inherits your property.

- Excluded heirs: Individuals you may have wanted to inherit may not receive anything.

- Legal complexities: Obtaining succession certificates and legal heir certificates can be time-consuming.

Frequently Asked Questions

What are the property inheritance rights of grandchildren?

Grandchildren inherit their grandparent’s property only if their parent (the grandparent’s child) has predeceased the grandparent. They inherit the share their parent would have received.

What happens if a father disowns his child from the property?

- Ancestral Property: A father cannot disown his child; the child has a birthright.

- Self-Acquired Property: The father can choose to exclude a child through a will.

Who inherits the property in India if there is no will?

Property is distributed among legal heirs according to the succession laws applicable to the deceased’s religion.

Can a daughter claim her father’s property after marriage?

Yes, after the 2005 amendment to the Hindu Succession Act, married daughters have equal rights as sons.

Do adopted children have the same inheritance rights?

Yes, legally adopted children have the same rights as biological children under Hindu law.

Can a live-in partner inherit property?

Unless specified in a will, live-in partners generally do not have automatic inheritance rights.

What is a succession certificate, and when is it required?

A succession certificate is a document issued by a civil court to the legal heirs of a deceased person. It is required for transferring debts and securities.

About Sooper Kanoon

Sooper Kanoon is a leading legal services platform dedicated to simplifying legal processes for individuals and businesses across India.

FAQs about Sooper Kanoon

Q: What services does Sooper Kanoon offer?

A: Sooper Kanoon offers a wide range of legal services, including:

- Assistance with property inheritance and succession planning.

- Drafting and registration of wills.

- Legal heir and succession certificate applications.

- Expert consultation on personal laws across different religions.

Q: How can Sooper Kanoon help me with inheritance issues?

A: Our team of experienced lawyers can guide you through:

- Understanding your rights under various inheritance laws.

- Drafting a legally sound will.

- Resolving disputes among heirs.

- Navigating the legal processes for asset transfer.

Q: Is Sooper Kanoon’s service available nationwide?

A: Yes, we provide services across India, connecting you with legal experts familiar with local laws and regulations.

Q: How do I get started with Sooper Kanoon?

A: Visit our website at sooperkanoon.com or call our helpline to schedule a consultation.

Conclusion

Understanding property inheritance laws in India is essential to ensure that your assets are distributed according to your wishes and to protect the rights of your loved ones. Whether it’s drafting a will, knowing your rights as an heir, or navigating the complexities of personal laws, being informed is the first step towards effective estate planning.

If you have questions or need legal assistance, don’t hesitate to reach out to professionals who can guide you through the process.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. For specific legal concerns, consult with a qualified attorney.

For more information or assistance with inheritance laws and estate planning, contact Sooper Kanoon today.